Counting today, we are only 79 DAYS away from the 1099s filing deadline (box 7).

Therefore, it is much better to be prepared and ready, than to wait for the deadline, which is never a good idea!

So, Quickbooks Online finally opened up the review option for the current year. Just last week we were only able to view last year’s 1099’s reports. But, as of this month, we are now able to review the current year, and get ready ahead of the time for the upcoming tax season!

To review your 1099s, Go to your Quickbooks Online (QBO) file, and navigate to (1) Expenses > (2) Vendors > (3)Prepare 1099s*

(3*) One button is housing two other options, and if you don’t see the “Prepare 1099s” option, then click on the down error next to the “Pay Bills” or “Order Checks’ and you will be able to see Prepare 1099s option*

On the very next page, you will be able to read more about the 1099s filing, deadlines, and read through FAQs. It is a very good idea to read through at least once a year:

On the next page you will be able to review the following:

- Name of the company, business address, and Tax ID

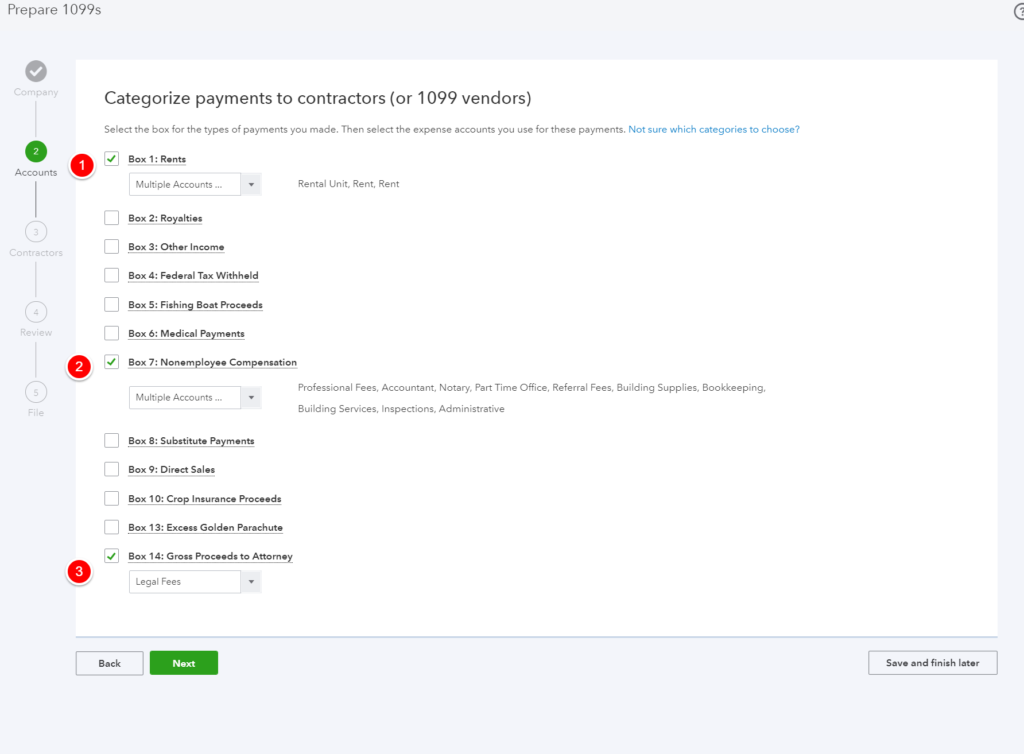

2. Review, add or modify accounts that are currently checked for the 1099 reporting. Here you can also make sure that the correct accounts are marked correctly ( i.e. Legal Expenses are not marked in the Nonemployee Compensation group.. etc)

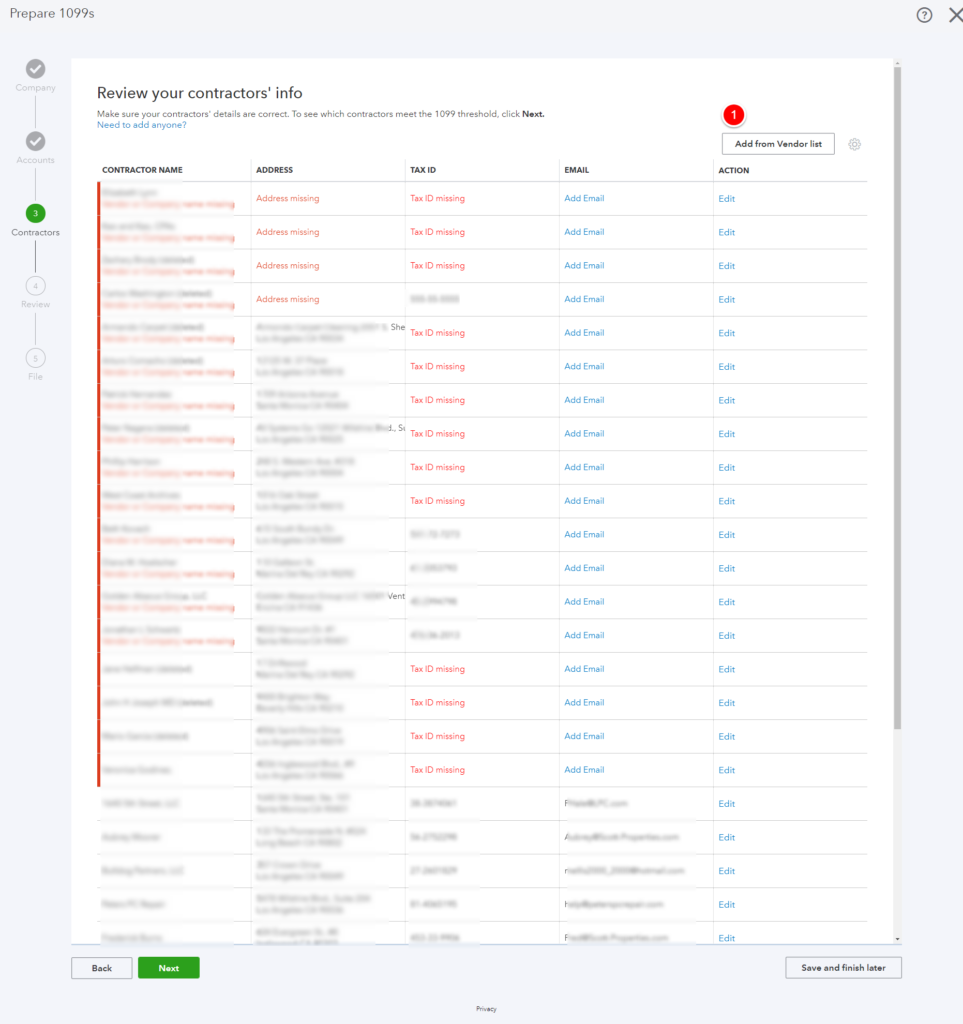

3. View the list of ALL vendors and confirm that all 1099’s vendors are marked to be tracked. Also, it is a VERY GOOD IDEA to add emails for each contact as the email delivery of the 1099’s forms can be 1/10th of the cost of the snail mail delivery of the 1099’s.

Make sure you do have:

W9 from any vendor, regardless of the amount you have paid the vendor in one year!

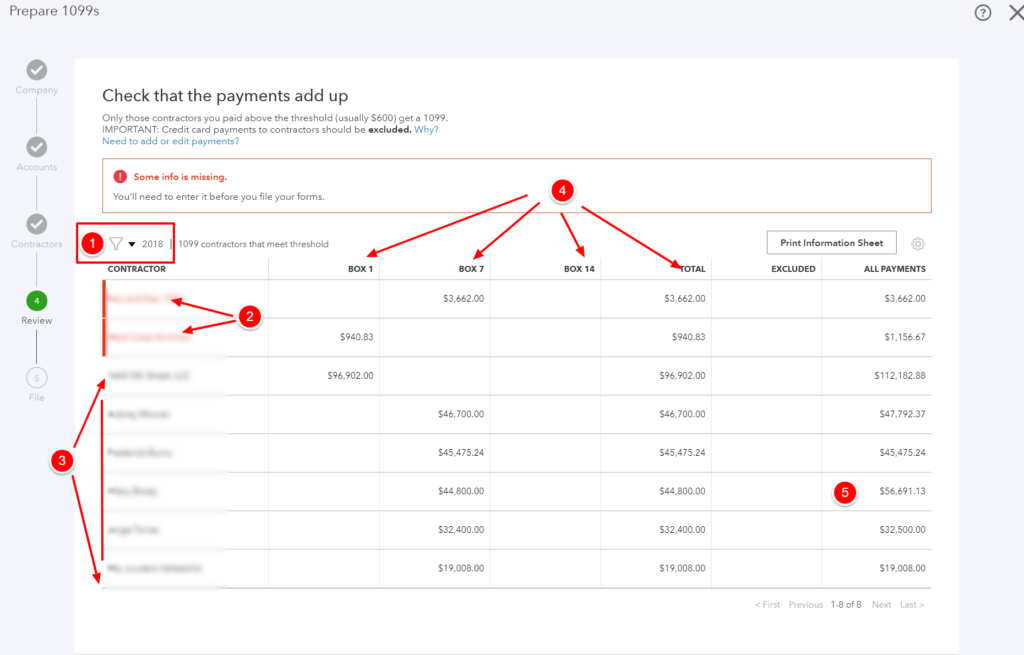

4. It’s now time to preview (review) the 1099s

Pay attention to:

- The correct year is selected!

- Gather the missing information for the vendors listed in red

- Review the amounts in boxes

- Review why there is a difference between the ALL PAYMENTS and the BOX (that was reported) (if any

Books LA is jumping on the review for all of our clients! And so should you!

We can never be too prepared.

Tips:

- Ask for a fresh W9 every 3 years. It is always a good idea to have current W9 as the addresses, entity types or DBA names can change.

- Obtain a W9 regardless of the amount! NO exception. Why? Besides many other reasons here are two very important ones:

- Failure to report 1099 for the lack of W9 can result in the 28% in backup withholding, plus penalties, plus interest! That $1000.00 expense that was a good deal is now costing you $280.00 +( pen.+int%) * years!

- Vendor received less than $600.00 this year, but the next one he receives over $600.00. A few months later it’s time to do 1099’s and the vendor is MIA. They got their money, and don’t feel its urgent to comply. What do you do? Refer to the previous bullet point, and be ready to pay!

Happy Tax Season (almost)!