by Jelena Arkula | Sep 19, 2022 | App Review, Cloud Accounting Option and Reviews, Document Management, Procedures, ScanSnap, Uncategorized

If you have filled the taxes and avoided filing the extension – Congratulations! Taxes are done, and you might think it’s too early to talk about the Tax Year 2019. The truth is, this IS a perfect time! Imagine its January 2020, and: Your Financial Statements are done...

by Jelena Arkula | Sep 19, 2022 | 1099, Cloud Accounting Option and Reviews, Procedures, Uncategorized

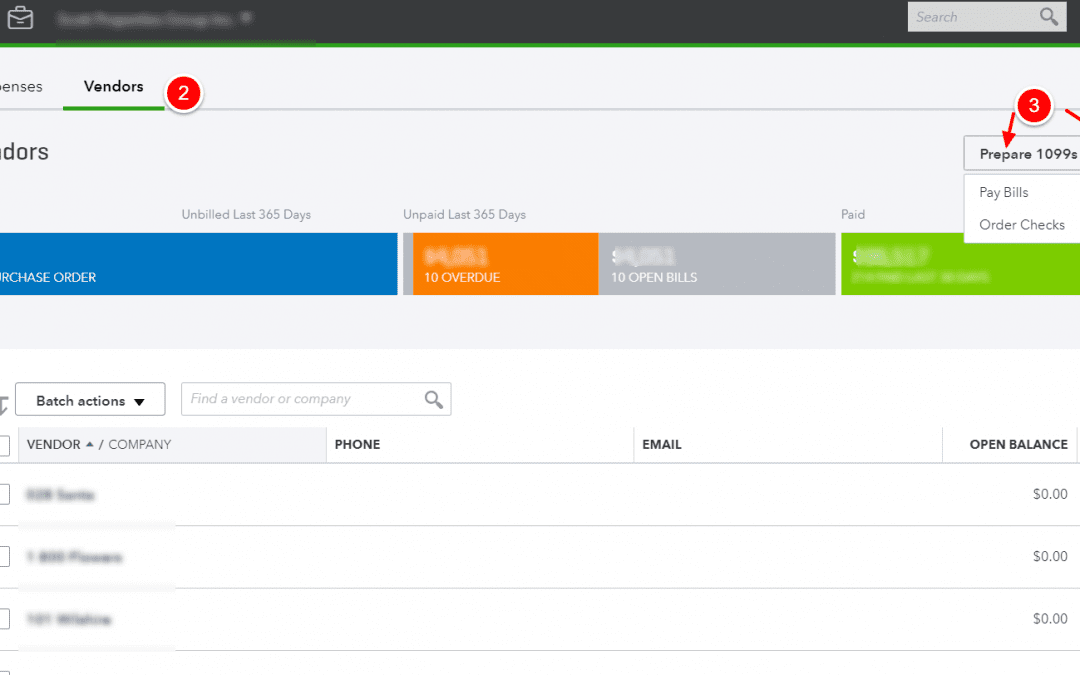

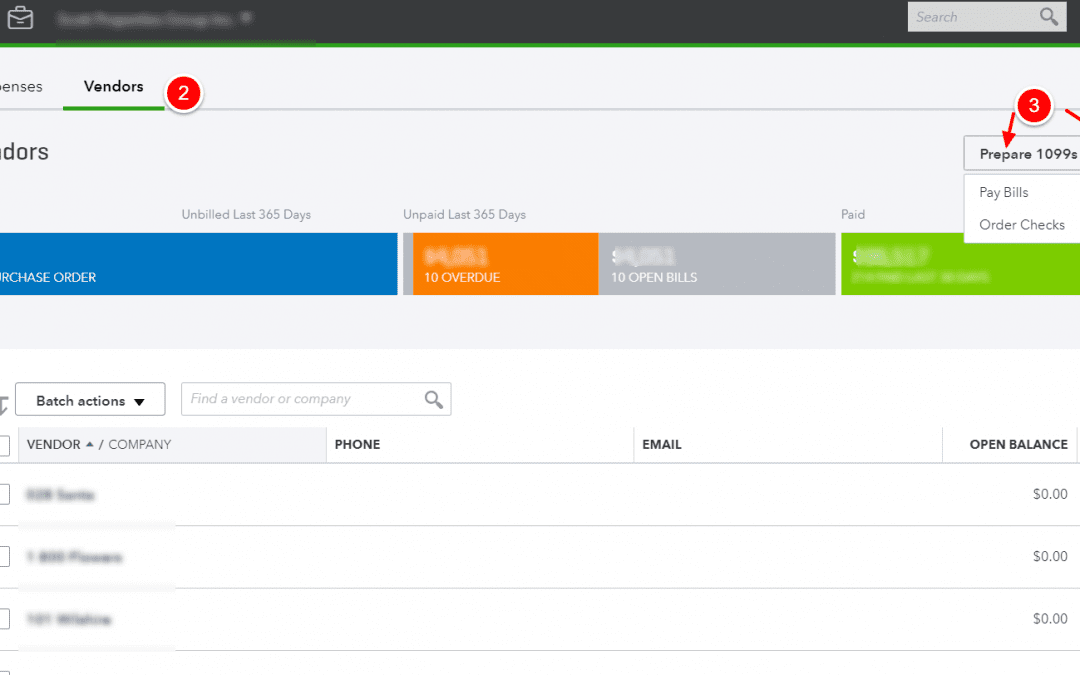

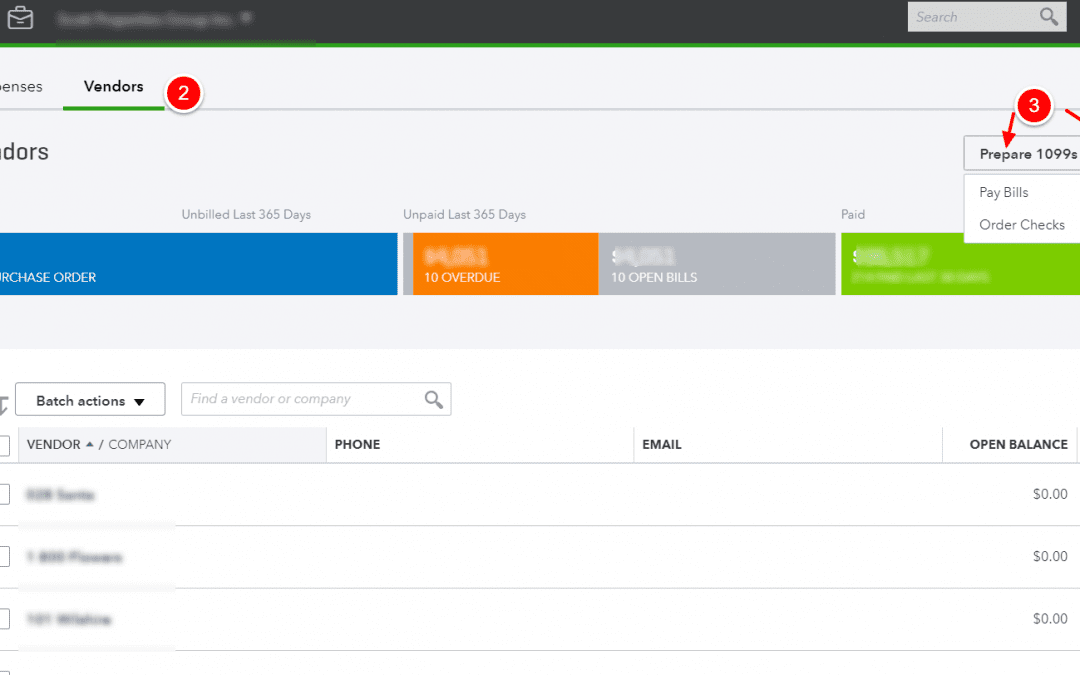

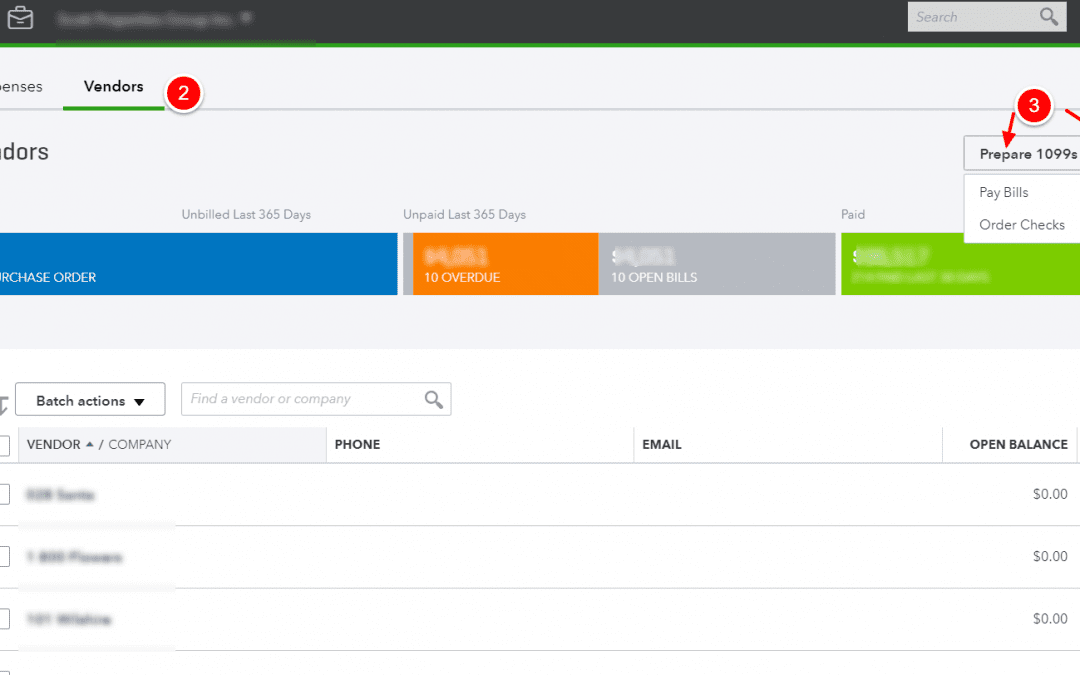

Counting today, we are only 79 DAYS away from the 1099s filing deadline (box 7). Therefore, it is much better to be prepared and ready, than to wait for the deadline, which is never a good idea! So, Quickbooks Online finally opened up the review option...

by Jelena Arkula | Sep 19, 2022 | Dining, Procedures, Uncategorized

What is the difference? Is there a difference? Why does it matter? Mike Russo, from Less Taxing Services, LLC wrote a good, entertaining and clear guide when in comes to meals and the deduction parentage. “When I talk to clients about the need for professionals...