by Jelena Arkula | Dec 14, 2022 | Procedures

In today’s digital world, it’s almost too easy to start a new subscription for various products and services. But if you find yourself with too many subscriptions or subscriptions you no longer use, it may be time to consider canceling them. Not only can canceling...

by Jelena Arkula | Sep 19, 2022 | App Review, Cloud Accounting Option and Reviews, Document Management, Procedures, ScanSnap, Uncategorized

If you have filled the taxes and avoided filing the extension – Congratulations! Taxes are done, and you might think it’s too early to talk about the Tax Year 2019. The truth is, this IS a perfect time! Imagine its January 2020, and: Your Financial Statements are done...

by Jelena Arkula | Sep 19, 2022 | 1099, Cloud Accounting Option and Reviews, Procedures, Uncategorized

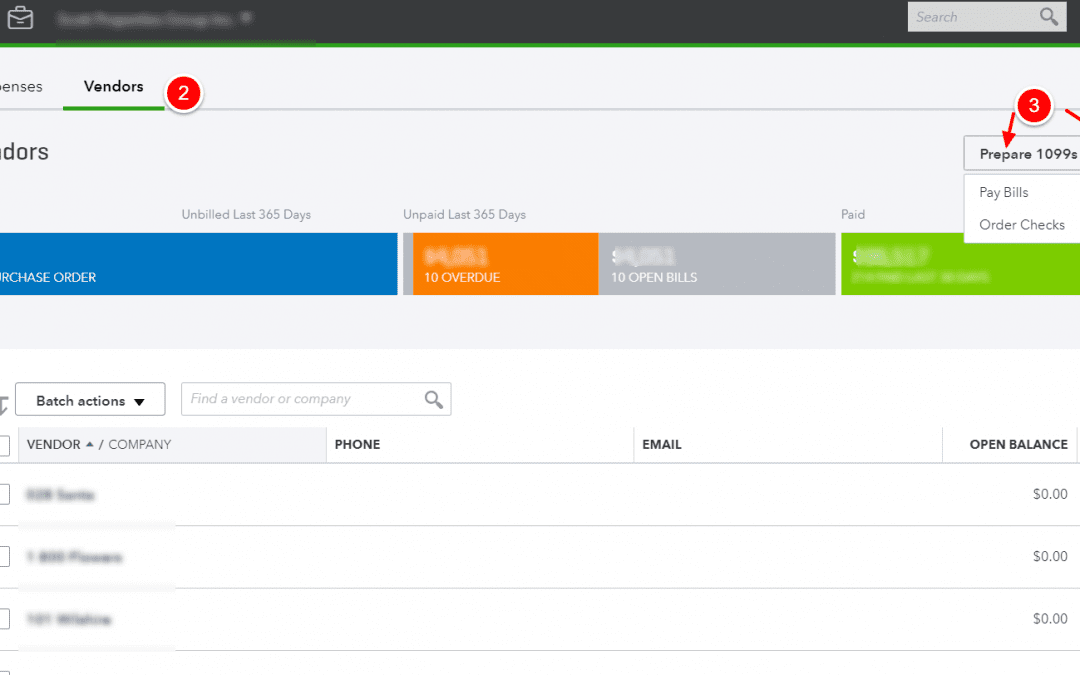

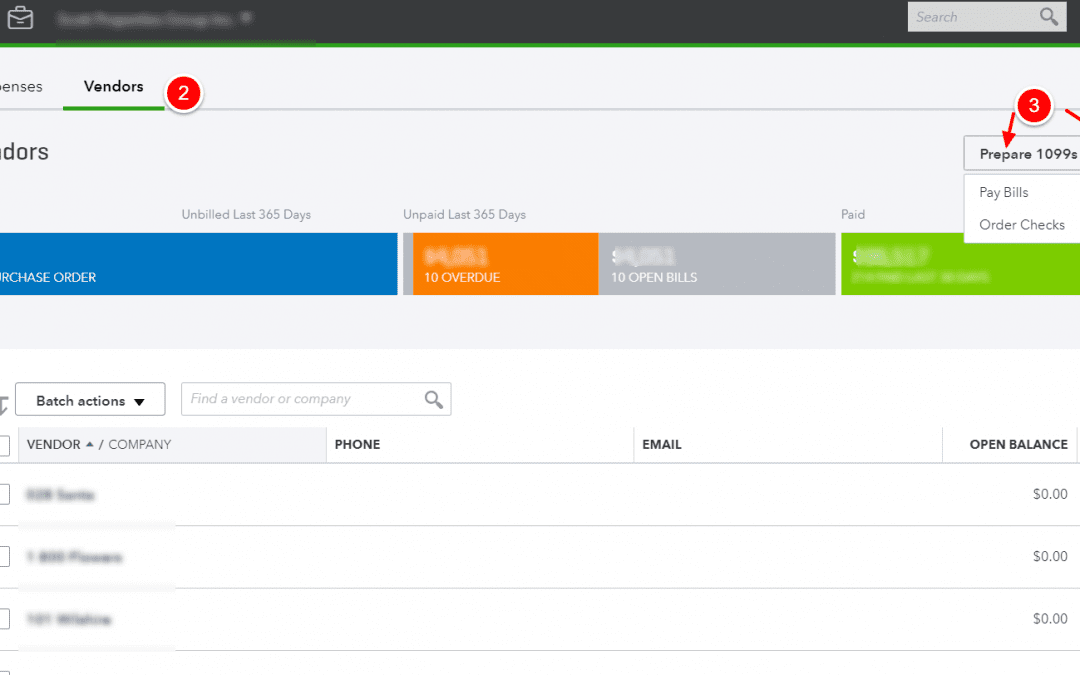

Counting today, we are only 79 DAYS away from the 1099s filing deadline (box 7). Therefore, it is much better to be prepared and ready, than to wait for the deadline, which is never a good idea! So, Quickbooks Online finally opened up the review option...

by Jelena Arkula | Sep 19, 2022 | 1099, Procedures

We are often asked what is the difference between the Independent Contractor and an employee. Often times employers are turned off by hiring an employee due to the cost. However, engaging an independent contractor that is actually classified as an employee can we very...

by Jelena Arkula | Sep 19, 2022 | App Review, bitcoin, Cloud Accounting Option and Reviews, cryptocurrency, Document Management, payment processing, Procedures, ScanSnap

We are often asked what is so different between us and other bookkeeping companies. From the outside, it would appear that we are all similar. At the end, all bookkeeping companies should be able to provide the same service; providing financial reports, bank...

by Jelena Arkula | Sep 19, 2022 | App Review, Cloud Accounting Option and Reviews, Document Management, Procedures, ScanSnap

We received a call today from a potential client; a law firm, looking for a new bookkeeper since their bookkeeper is retiring. Like with any other call, we asked them for the overview and a roadmap of the current process they have with their bookkeeper. Currently...