by Jelena Arkula | Sep 19, 2022 | 1099, Cloud Accounting Option and Reviews, Procedures, Uncategorized

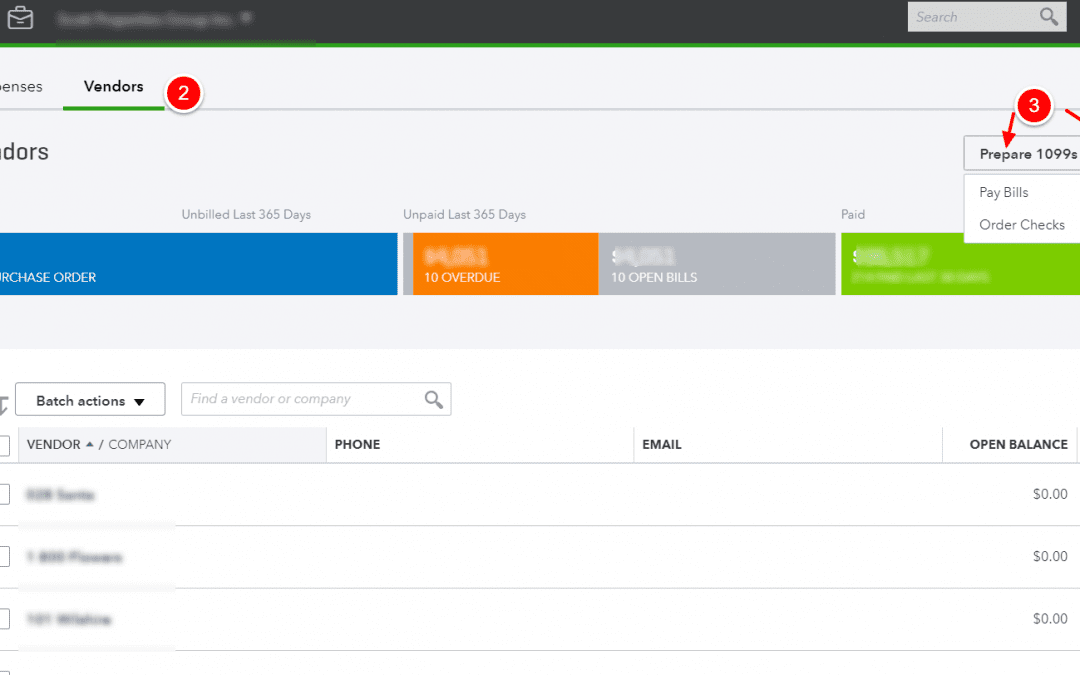

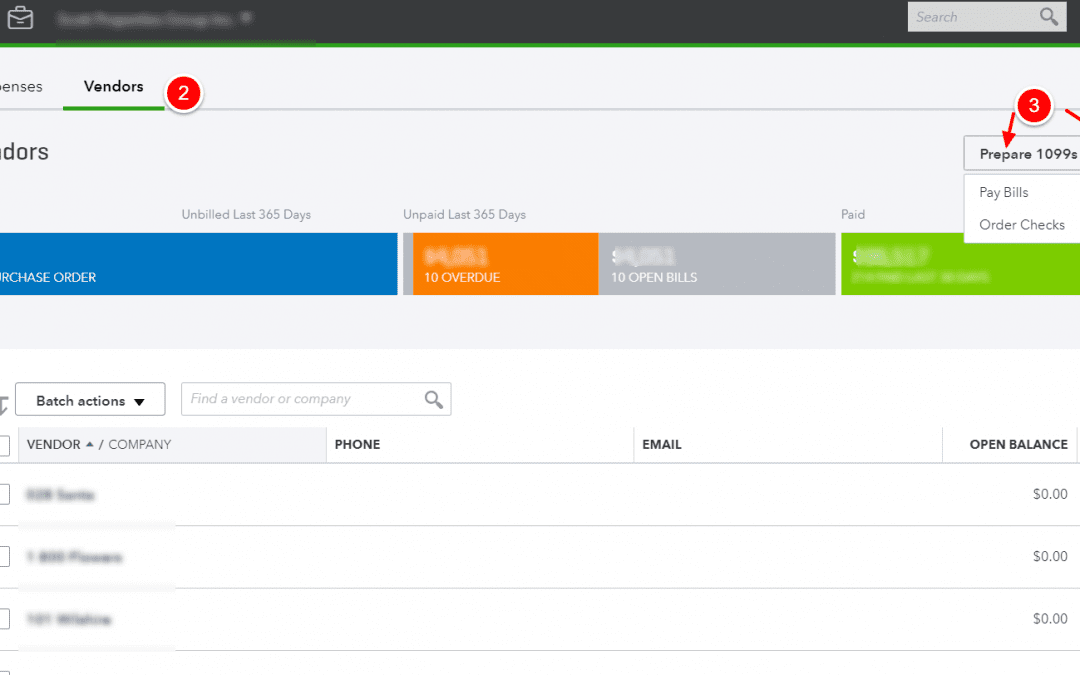

Counting today, we are only 79 DAYS away from the 1099s filing deadline (box 7). Therefore, it is much better to be prepared and ready, than to wait for the deadline, which is never a good idea! So, Quickbooks Online finally opened up the review option...

by Jelena Arkula | Sep 19, 2022 | 1099, Procedures

We are often asked what is the difference between the Independent Contractor and an employee. Often times employers are turned off by hiring an employee due to the cost. However, engaging an independent contractor that is actually classified as an employee can we very...