Last updated: February 11, 2026

Clean books prevent audit issues in 2026 by giving you real-time visibility into sales tax compliance, payroll tax obligations, and business license requirements before problems turn into penalties. When state agencies and automated matching systems flag discrepancies, accurate records are your only defense.

This post is for startup founders and construction business owners who need reliable bookkeeping services to stay compliant during the 2026 audit wave. You'll learn what professional bookkeeping includes, how much it costs, and why your CPA depends on clean data to protect you.

Why the 2026 audit wave is different

State and federal agencies now use automated systems to cross-check your bank deposits, payroll filings, and sales tax reports in real time. This is not the year-end audit your parents worried about. This is continuous monitoring.

If your QuickBooks categories are messy, your payroll tax deposits are late by even a day, or your sales tax nexus calculation is wrong, the system flags you automatically. No human review. No benefit of the doubt.

Startups scaling across state lines and construction companies juggling 1099 contractors are the highest risk targets. Why? Because growth creates complexity fast. One new employee in another state means payroll registration, state unemployment insurance, and potentially a business license. One project in a new county might trigger sales tax obligations you did not know existed.

The cost of being wrong has gone up. Late payroll tax penalties start at 2% and compound weekly. Sales tax underpayment can trigger retroactive bills going back three years, plus interest.

What our bookkeeping services include

Our bookkeeping services are designed for businesses that need more than data entry. We focus on the details that prevent audit exposure.

Transaction categorization with tax implications in mind. Every expense and income entry is coded correctly so your sales tax liability is accurate and your payroll tax accounts balance. We do not use "Miscellaneous" as a catch-all.

Monthly reconciliation of all accounts. Bank accounts, credit cards, and loan balances are reconciled every month so your CPA has a clear picture at year end. This also catches duplicate transactions, missed payments, and unauthorized charges before they snowball.

Sales tax tracking and nexus monitoring. We track where you are doing business and alert you when you are approaching economic nexus thresholds in new states. For construction firms working across county lines, this is critical. For startups selling online, this prevents surprise bills.

Payroll tax compliance support. We make sure your payroll records match your 941 filings, your state withholding, and your unemployment insurance reports. If there is a mismatch, we catch it before the state does.

Business license and registration tracking. We maintain a checklist of your active licenses, renewal dates, and new registration requirements triggered by hiring or expansion. This is especially important for construction businesses that need contractor licenses in multiple jurisdictions.

1099 and W-2 preparation support. We ensure contractor payments are tracked separately and flagged for 1099 reporting. For employees, we verify that W-2 wages match payroll records so there are no discrepancies when your CPA files.

We use QuickBooks Online and Xero exclusively. Both platforms integrate with payroll providers, banks, and state filing systems, which means less manual entry and fewer errors.

Need help staying audit-ready?

We are Books LA, a Los Angeles-based bookkeeping team specializing in startup bookkeeping and construction bookkeeping. We are certified ProAdvisors for QuickBooks Online and Xero.

Our clients are founders managing remote teams and construction business owners juggling multiple job sites. We handle the books so you can focus on growth without worrying about compliance surprises.

If you want clean, audit-ready records, schedule a call with us. We will review your current setup and give you a clear plan.

How much professional bookkeeping services cost

Pricing for bookkeeping services depends on transaction volume, payroll complexity, and whether you need cleanup or just ongoing monthly work.

Monthly bookkeeping for startups: $400 to $800 per month for businesses with up to 100 transactions and simple payroll (under 10 employees). This includes transaction categorization, reconciliation, and sales tax tracking.

Monthly bookkeeping for construction firms: $600 to $1,200 per month. Construction businesses typically have more complexity because of job costing, subcontractor payments, and multi-state licensing. We track costs by project and ensure 1099s are ready at year end.

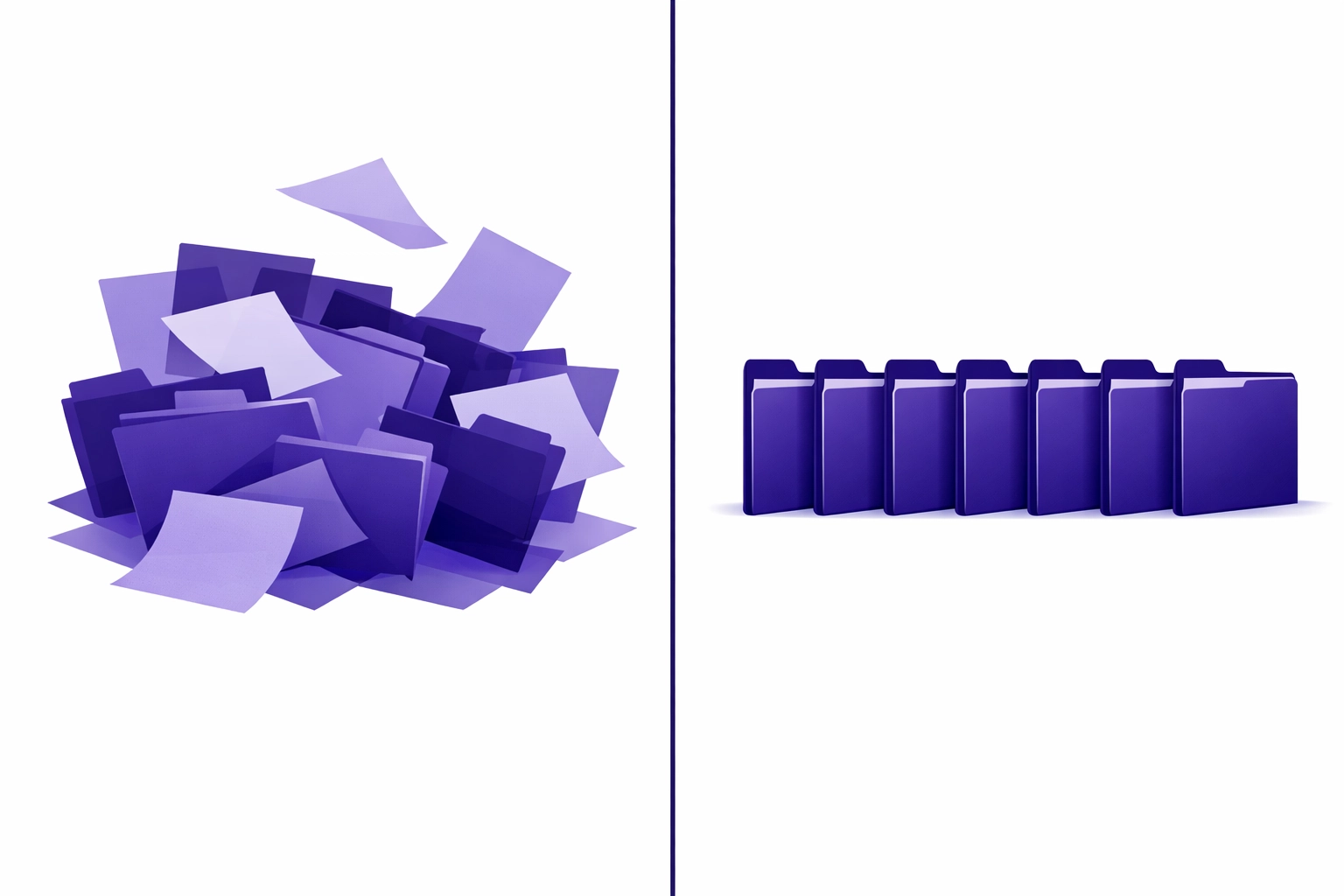

Bookkeeping cleanup: $1,000 to $3,000 for a full year of cleanup, depending on how messy the books are and how many months need to be corrected. Cleanup includes re-categorizing transactions, reconciling accounts, fixing payroll mismatches, and preparing accurate reports for your CPA.

Payroll tax setup and compliance monitoring: Included in monthly pricing if you use a payroll provider like Gusto or ADP. If you need us to file directly or manage multi-state payroll registration, we charge an additional $150 to $300 per month.

Sales tax nexus review: $250 one-time fee to audit where you are doing business and confirm whether you have nexus obligations in other states. This is especially valuable if you have grown quickly or started selling in new markets.

Most clients start with a cleanup to get current, then move to monthly bookkeeping services to stay compliant going forward.

How long the setup process takes

Setup depends on your starting point. If your books are current and organized, we can onboard you in one week. If you need cleanup, expect four to six weeks.

Week 1: Discovery and access. We review your current QuickBooks or Xero file, your bank statements, payroll reports, and sales tax filings. We identify gaps, mismatches, and missing documentation.

Week 2 to 3: Cleanup (if needed). We re-categorize transactions, reconcile accounts, and fix payroll tax discrepancies. If you have been using spreadsheets or paper records, this takes longer because we need to manually enter historical data.

Week 4: CPA coordination. We send a summary of corrections to your CPA so they can adjust prior filings if necessary. We also set up a shared process for year-end tax prep so nothing is missed.

Week 5 and beyond: Monthly close process. Once the books are clean, we move into a monthly rhythm. Transactions are categorized weekly, accounts are reconciled by the 10th of each month, and you get a summary report showing profit, sales tax liability, and payroll tax status.

For construction bookkeeping, we also set up job costing so you can track profitability by project. This takes an extra week because we need to build a chart of accounts that matches how you bid and invoice jobs.

Why your CPA needs clean data for audit protection

Your CPA does not do bookkeeping. They rely on the data you give them to prepare accurate tax returns and defend you if you get audited.

When your books are messy, your CPA has two choices. They can spend hours cleaning them up (which you pay for at $200 to $400 per hour), or they can file based on incomplete data and hope nothing gets flagged. Neither option protects you.

Sales tax compliance requires transaction-level accuracy. If your sales are not categorized by state and taxability, your CPA cannot verify whether you collected the right amount. If the state audits you, they will assume you underreported and bill you for the difference, plus penalties.

Payroll tax filings must match your books exactly. If your 941 shows $50,000 in wages but your QuickBooks shows $48,000, the IRS will assume payroll tax was underreported. Your CPA cannot fix this at year end because payroll tax is filed quarterly.

Business license lapses create liability exposure. If your contractor license expires and you continue working, you are operating illegally. Your CPA does not track this. You need bookkeeping services that include compliance monitoring so nothing falls through the cracks.

1099 reporting errors trigger automatic IRS notices. If you pay a contractor $10,000 but report $8,000 on the 1099, the IRS sends a notice to both you and the contractor. Your CPA cannot correct this after the fact because 1099s are filed in January based on the prior year's data.

Clean books mean your CPA can file with confidence. They also mean you can answer questions quickly if you do get audited, because every transaction is documented and categorized correctly.

We do not provide income tax advice. We work closely with your CPA to ensure they have the clean data they need to file your returns accurately. For income tax strategy and filing, you should consult your CPA directly.

About Books LA

We are a Los Angeles-based bookkeeping team specializing in startup bookkeeping and construction bookkeeping. We are certified ProAdvisors for QuickBooks Online and Xero.

Our clients include SaaS startups managing remote teams across multiple states and construction companies running multiple job sites with subcontractor crews. We handle monthly bookkeeping, payroll tax compliance, sales tax tracking, and 1099 preparation.

We do not just enter transactions. We monitor nexus thresholds, track business license renewals, and coordinate with your CPA so you stay compliant without constant stress.

If you need reliable bookkeeping services, reach out to us. We will review your situation and give you a clear plan.

Ready to protect your business?

The 2026 audit wave is not slowing down. State agencies and automated systems are flagging businesses faster than ever, and the penalties for errors are steep.

You do not need to handle this alone. Our bookkeeping services give you clean, accurate records so your CPA can file with confidence and you can focus on running your business.

Schedule a call with us today. We will walk you through what we need, how pricing works, and how long it takes to get you audit-ready.

Frequently Asked Questions

What audit risks do startups and construction companies face in 2026?

Startups scaling across state lines risk sales tax nexus violations and payroll tax penalties from unregistered employees. Construction companies face 1099 misclassification issues, business license lapses, and job costing errors that trigger gross receipts tax problems. Both industries are flagged by automated systems when their reported income does not match bank deposits.

How much do bookkeeping services cost for a startup with 10 employees?

Monthly bookkeeping for a startup with 10 employees and up to 100 transactions typically costs $400 to $800 per month. This includes transaction categorization, bank reconciliation, payroll tax tracking, and sales tax monitoring. If you need cleanup first, expect to pay $1,000 to $2,000 for a full year of corrections.

Can you handle payroll tax compliance for multi-state teams?

Yes. We track payroll tax obligations for every state where you have employees. We coordinate with your payroll provider to ensure state withholding, unemployment insurance, and local taxes are filed correctly. If you need us to manage registration in new states, we charge an additional $150 to $300 per month depending on complexity.

Do I need separate bookkeeping for construction job costing?

Yes. Construction bookkeeping requires job costing so you can track profitability by project. We set up a chart of accounts that matches how you bid and invoice jobs, and we track costs by project so you know which jobs are making money and which are losing it. This is included in our monthly construction bookkeeping pricing.

What happens if I have not filed sales tax in a state where I have nexus?

You need to register immediately and file back returns. We can help you calculate what you owe based on your transaction history, but you will need to work with your CPA or a sales tax attorney to negotiate penalties. The longer you wait, the more expensive it gets. Our bookkeeping services include nexus monitoring so this does not happen going forward.

How do you make sure 1099s are accurate?

We track contractor payments separately throughout the year and flag them for 1099 reporting. At year end, we verify that total payments match your bank records and payroll system. We also check for duplicate payments or missing invoices. We prepare a 1099 summary for your CPA, but they are responsible for filing.

Can you work with my existing CPA?

Yes. Most of our clients have an existing CPA relationship. We provide monthly reports and year-end summaries so your CPA has clean data to file your returns. We also coordinate on corrections and answer questions during tax prep. We do not provide income tax advice. That is your CPA's role.

What software do you use for bookkeeping?

We use QuickBooks Online and Xero exclusively. Both platforms integrate with banks, payroll providers, and state filing systems, which reduces manual entry and errors. If you are using a different system, we can migrate you to QBO or Xero as part of the setup process.